House value declines are starting to ease off across the place, led by Sydney, Melbourne and Brisbane which all observed a decreased amount of drop last month.

In accordance to CoreLogic, national residence price ranges declined 1.4% in the thirty day period of September, which was more compact than the 1.6% drop recorded in August.

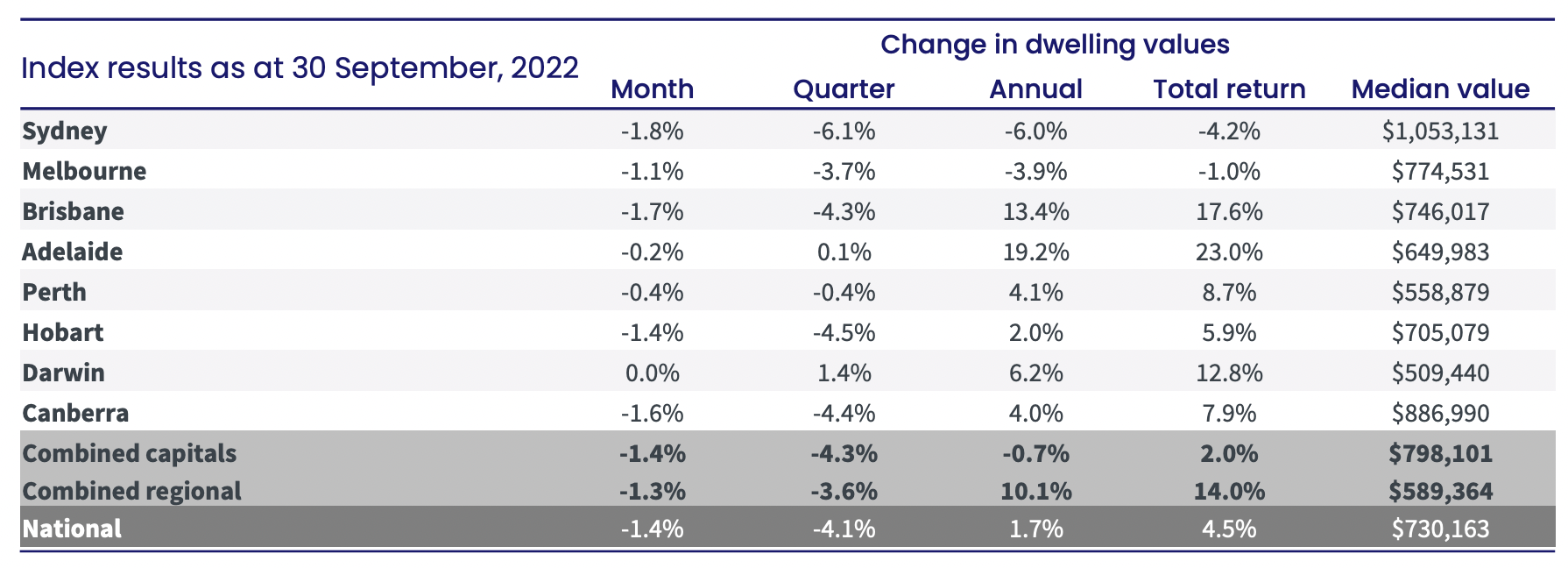

Sydney rates ongoing to drop, falling 1.8%, Brisbane price ranges have been off 1.7% and Melbourne was down 1.1%. Canberra and Hobart also noticed values tumble, down 1.6% and 1.4%.

Perth and Adelaide, the two most resilient metropolitan areas all through the downturn, have now commenced to see costs start to roll above as very well, dropping .4% and .1%.

Darwin continues to be the only cash metropolis the place housing values haven’t started off to development decrease, even though dwelling values continue to be 10.1% under the 2014 peak.

Supply: CoreLogic

According to CoreLogic’s study director, Tim Lawless, it is too early to propose the housing market place has moved via the worst of the downturn.

“It’s possible we have observed the initial shock of a immediate rise in curiosity costs move through the market and most debtors and prospective house potential buyers have now ‘priced in’ additional price hikes,” Mr Lawless said.

“However, if curiosity rates carry on to increase as quickly as they have considering that Could, we could see the price of decrease in housing values speed up after all over again.”

Mr Lawless mentioned there had been a selection of beneficial indicators about the month of September, aside from slowing declines.

“Auction clearance rates also trended upwards, albeit subtly, in September and purchaser sentiment nudged a tiny increased as perfectly on the again of robust labour market place ailments,” he said.

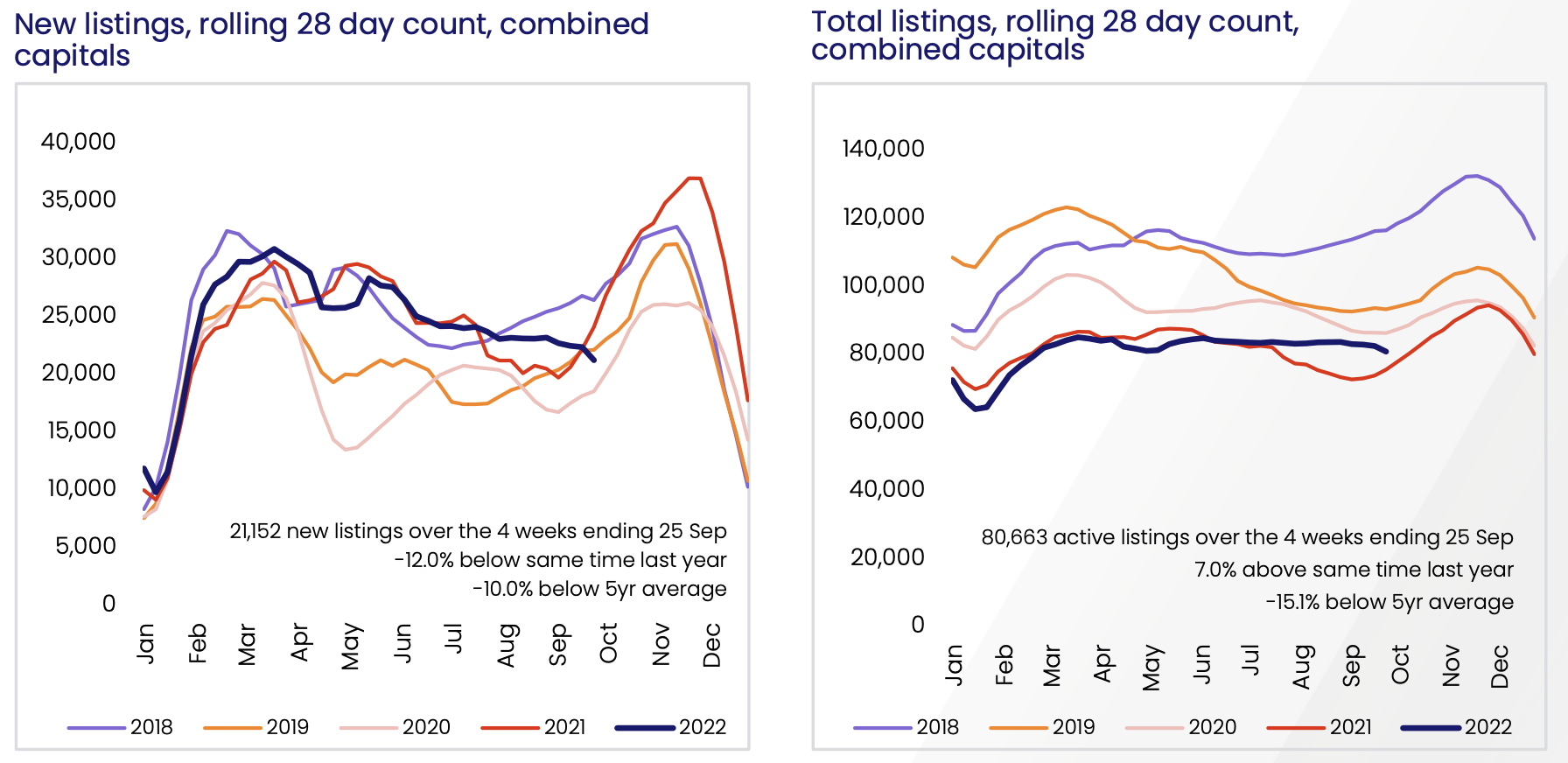

“We’ve also noticed the circulation of clean listings continue to slide as a result of the 1st month of spring, which is unusual for this time of the calendar year.”

Immediately after soaring 25.5% above the modern expansion cycle, housing values across the blended capitals index are now 5.5% beneath the new peak, although regional selling prices, which recorded more robust expansion circumstances as a result of the upswing (41.6%), are now down 3.6%.

Mr Lawless said there keep on to be considerable discrepancies concerning diverse markets around the state.

“We are still observing some resilience to benefit falls all over the much more economical locations of Adelaide and Perth, as well as some regional marketplaces related with agriculture, mining and tourism,” he claimed.

The most significant cumulative falls have been concentrated in places of Sydney’s Northern Beaches, including Warringah, Pittwater and Manly the place housing values are down at least 14.5% given that transferring via a peak in early 2022, as well as flood-influenced parts across Richmond – Tweed.

“These spots noticed housing values increase amongst 38% and 62% via the development cycle, so most home homeowners are even now perfectly ahead in terms of fairness in their home,” Mr Lawless said.

Just one of the good reasons for the resilience of quite a few house marketplaces about the place has been the slowdown in new listings hitting the sector.

The range of new listings added to money city housing markets around the four months ending September 25th was 12% reduce than the exact time period a 12 months ago and 10% beneath the previous 5-12 months average. Darwin and Canberra are the only exceptions, with each metropolitan areas recording a increased than regular circulation of new listings about the previous four weeks.

“It looks potential vendors are ready to wait around out the housing downturn, somewhat than try to promote less than much more tough current market conditions,” Mr Lawless said.

“We have not viewing any proof of distressed product sales or panicked promoting by way of the downturn to date in actuality, it has been the reverse, with the pattern in recently mentioned homes continuing to diminish at a time when freshly advertised inventory concentrations would usually be shifting through a seasonal ramp up.”

Source: CoreLogic

In the meantime, right after a document-placing speed of rent growth in excess of the past couple many years, boosts are also beginning to start out to stagnate.

The countrywide rental index improved by .6% in September, the lowest month-to-month rise in rents given that December 2021. At the nationwide degree, rental development moved by means of a peak in Could 2022 with a 1.% rise due to the fact that time, the monthly speed of rental advancement has been easing.

This development in rents is evident throughout most areas, but has been clearest throughout regional Australia exactly where month to month rental boosts have minimized from a peak of 1.4% in January 2021 to just .3% in September 2022.

Mr Lawless said the slowdown in rental development came as a bit of a shock supplied the deficiency of rental offer all-around the place.

“A gradual slowdown in rental development in the deal with of these types of very low vacancy fees could be an early signal that renters are reaching an affordability ceiling,” he reported.

“Since the onset of COVID, capital town rents have risen 16.5% and regional rents are up 25.1%.”

“It’s most likely renters will be progressively trying to get rental selections throughout the medium to substantial density sector, exactly where renting is more affordable, or maximising the variety of people today in the tenancy in an effort to unfold bigger rental fees throughout a more substantial family.”

“A materials increase in rental offer appears a prolonged way off, considering non-public sector financial commitment exercise is trending lower and a larger than regular part of for sale listings are trader-owned properties.”

On the lookout ahead, the most crucial component influencing housing markets will be the trajectory of desire costs, which remains highly unsure Mr Lawless reported.

The money charge has surged 225 foundation details better as a result of the tightening cycle to-date curiosity premiums have not risen at this rapidly a pace due to the fact 1994, when homes have been arguably less sensitive to a sharp increase in the expense of credit card debt.

“In the September quarter of ’94, the ratio of housing credit card debt to residence disposable income was just 46.8. The impression of a greater expense of financial debt is considerably additional significant now, with a housing personal debt to house revenue ratio of 143.7 recorded in March 2022,” Mr Lawless explained.

The excellent information is that inflation may be going via a peak. With the new launch of a every month CPI indicator, it appears like headline inflationary pressures may well have eased a minimal via the September quarter, with the Ab muscles reporting a reduction in yearly inflation from 7.% above the yr ending July to 6.8% about the year ending August.

According to Mr Lawless, If inflation is slowing, we could see the RBA start out to relieve back again on the aggressive level mountaineering cycle that commenced in May possibly and when fascination rates stabilise, housing rates are probably to come across a ground.

Potent labour market ailments should really assistance to include any content increase in home loan distress. With the national unemployment amount at 3.5% in August and wages advancement picking up, we aren’t anticipating to see a materials rise in distressed listings or compelled revenue.

“We will be looking at for any indicators of market place distress as the dual influence of larger desire prices and substantial inflation affect house budgets. To day, the stream of new ‘for sale’ listings has in fact trended lower as sellers retreat to the sidelines, a great indicator that property homeowners are weathering the downturn,” Mr Lawless mentioned.

“As desire premiums continue to increase and inflation stays higher, it’s reasonable to count on home paying will pull back…While we are nevertheless to see any proof that house paying is staying reined in, it’s possible that households will have to have to curtail their discretionary investing in get to maintain their debt servicing obligations while also dealing with bigger charges on non-discretionary products these kinds of as food stuff and fuel.”

For consumers, stock concentrations have normalised throughout the much more costly money town marketplaces, supplying far more option and a far better negotiation position, even though for sellers, circumstances have grow to be much more hard amid lower demand from customers.