Home loan demand appears to have nowhere to go but down, as fascination charges go up.

Application volume dropped 1.2% last week in contrast with the preceding week, according to the House loan Bankers Association’s seasonally altered index. The week’s success involve an adjustment for the observance of Labor Day. Considering the fact that previous yr, homebuyers’ demand from customers for mortgages has fallen by virtually a 3rd.

Home finance loan fees, which had been easing slightly by July and August, pushed increased nevertheless again, after Federal Reserve Chairman Jerome Powell designed it distinct to buyers that the central financial institution would stay difficult on inflation, even if it caused individuals some agony.

The normal deal interest rate for 30-year preset-rate mortgages with conforming mortgage balances ($647,200 or less) amplified to 6.01% from 5.94%, with factors lowering to .76 from .79 (like the origination cost) for financial loans with a 20% down payment.

“The 30-12 months mounted mortgage fee hit the 6% mark for the very first time because 2008 – increasing to 6.01% – which is effectively double what it was a 12 months in the past,” reported Joel Kan, MBA’s associate vice president of economic and field forecasting.

Refinance demand fell one more 4% for the week and was 83% decreased than the identical 7 days a single 12 months in the past. With prices higher than 6%, only about 452,000 debtors could gain from a refinance, according to Black Knight, a mortgage loan know-how and information company. That is the lowest number on report. These handful of remaining candidates could only save about $315 per thirty day period for every borrower.

Home finance loan programs to obtain a house squeezed out a get of .2% from the previous 7 days, but have been 29% reduced than the very same 7 days 1 calendar year back. There was a bump up in demand for Veterans Affairs and USDA loans, which are favored by to start with-time consumers because they can present lower or no down payments.

“The unfold among the conforming 30-12 months preset house loan charge and both of those ARM and jumbo loans remained vast past 7 days, at 118 and 45 basis points, respectively. The large distribute underscores the volatility in capital markets thanks to uncertainty about the Fed’s next policy moves,” Kan added.

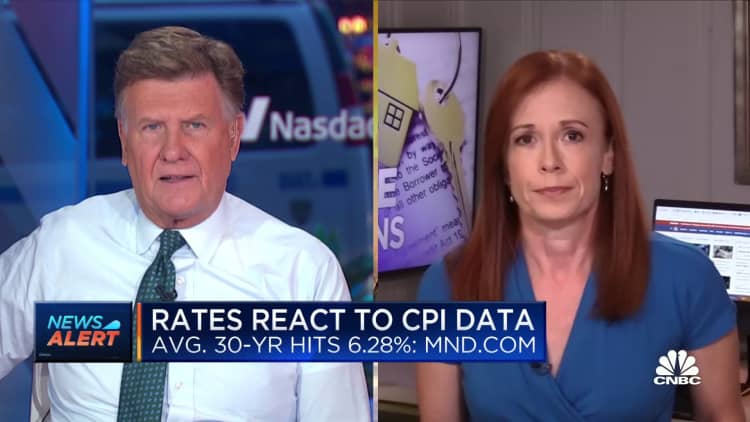

Mortgage loan rates jumped noticeably higher this week, immediately after the monthly inflation variety arrived in larger than anticipated. That had investors concerned that the Federal Reserve would hike prices far more than anticipated at its future assembly.

“It was just one of the final shoes to fall right before the Fed announcement on September 21st, and it arrived at a time the place the market had fully priced in a 75bp hike, but was willing to think about a little something even greater if the details was convincing,” wrote Matthew Graham, main functioning officer of Home loan News Every day. “This was arguably convincing enough for the Fed to at the very least open up the discussion.”