[ad_1]

Move #1 – Calculate Your Current Private Fees

Monetary blogger JD Roth suggests your recent expenditures (and not your earnings) are the very best beginning point to determine out how much cash you require to conserve for retirement. Once you know your latest costs, you can then make adjustments (like for inflation) to determine out your future wants.

This makes feeling, of study course, because fiscal independence means owning investments that shell out your dwelling expenses. Totally free from the need to perform for dollars, you can then do what matters.

The issue is that several of us don’t actually know our particular expenditures. Positive, you expend much less than you gain. And you likely help save a lot of money much too.

But if you want to obtain serious self-confidence in your prepare and maybe retire previously than you believed, you have to have to know your charges with a lot more certainty.

Tools to Enable You Compute Your Costs

If you are a economical nerd like me, you will most likely by now know your recent fees and even have a detailed spreadsheet! But if you are not a nerd nonetheless, right here are a few equipment to assist you get begun calculating your own expenditures:

-

- Spreadsheets – Normally a really basic, productive, and flexible resource to track your expenses. You can down load a absolutely free price range template in this article.

- Mint.com – This is a absolutely free on the net tool from Intuit that routinely tracks your individual expenditures by pulling facts from your financial institution accounts and credit history cards.

- YNAB (You Have to have a Funds) – This is a compensated software application that has more bells and whistles than Mint.

If you have not calculated your charges ahead of, just know that it won’t be a swift 60-second training. But it’s not mind-boggling possibly. I endorse scheduling a number of several hours on a weekend to really dig into the figures.

But for now, just make an educated guess and let us transfer on to the next phase.

Phase #2 – Adjust Charges For Retirement (if essential)

Will you expend extra, less, or the exact same in retirement? Of system, that is dependent on your condition. But never be astonished if the complete expenses are significantly less than you devote throughout your operating years.

Why would this be so?

What if you personal your home totally free and obvious? Won’t that conserve you income?

What if you receive most of your cash flow from rentals sheltered by depreciation? That is the place of this report, ideal? You will pay a ton considerably less in taxes with sheltered rental revenue when compared with the substantial salary years at do the job.

Other Examples of Financial savings

In addition, what if the free of charge time and adaptability you have as a retiree will allow you to negotiate a great deal extra than prior to? When you’re doing work a task 50 months for every year, that 2-week vacation in the summer season will be high-priced. Nevertheless, when you have numerous months of no cost time, you can pick out to travel through the instances of yr and to the locations exactly where you obtain very good deals. There are a lot of much more examples of discounts just like this.

But in the finish, you’ll want to make an estimate you are snug with. For some actual numbers and perspective, you could delight in “How Significantly Will It Price You to Stay in Retirement” by Darrow Kirkpatrick at CanIRetireYet.com.

Action #3 – Estimate Other Sources of Earnings

Will you have other resources of earnings when you retire? Or will rental properties be your only supply?

Other resources could incorporate:

I are inclined to greatly focus in a single sector (actual estate). I do like Warren Buffett suggests and “put my eggs in one basket and check out them really closely!” But I approach to continue diversifying in excess of time. So, an estimate of other money sources would make feeling.

And if genuine estate investing is only a small part of your general retirement system, this is wherever you include the other passive revenue streams from your portfolio. Mixing and balancing those people will acquire some wondering and most likely some specialist information. But actual estate can be the reliable and steady supply of income at the main of your approach.

Phase #4 – Produce a Profile of Your Retirement Rental House

Before in this short article, I described what a retirement rental house appeared like for my instance. I included qualities like:

-

- The assets sort

- The basic locale in just the place

- The specific spot in just a location

- The cost selection

- The expense and debt structure

- The rental revenue, internet working cash flow, and dollars-on-cash return

At a minimum amount in this phase, estimate the charge, debt composition, and hard cash-on-dollars return for your rental houses. The price tag and credit card debt framework can be figured out with your true estate agent and with your home loan loan providers, respectively.

Hard cash-on-Funds Return

For the income-on-income return, I never advocate likely under 6%, even on a free of charge and crystal clear assets in a good quality site. On the other hand, I also do not propose assuming you will get much larger returns like 15-20%. Although those people yields are probable and I have accomplished them, it is improved to develop a retirement system on a extra conservative foundation.

This upfront perform is actually the blessing and the curse of actual estate investing. Few people today will pick out to do it, but that leaves you with a lot less competition since you will!

Action #5 – Calculate Rental Qualities Wanted to Retire

Now we’re back again to the easy math and a few variables from the beginning of the article.

- Your approximated fees in retirement (E)

- Your wealth (aka fairness) invested in real estate (W)

- The produce or dollars-on-money return on that equity (r)

In this scenario, you by now have #1 and #3 from prior techniques, so you want to figure out #2 – the wealth to devote.

For example, if you want $80,000 income at retirement and expect to get an 8% hard cash on income return, you require to make investments fairness of $1 million.

W x 8% = $80,000

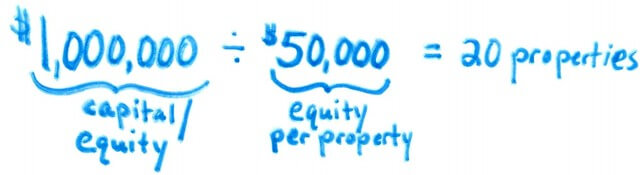

W = $1,000,000

With that amount in hand, your ultimate calculation is dependent on the home values and the personal debt construction you are going to pick out.

For illustration, if the houses in your market will expense $100,000 and if you approach to individual them free and obvious, you’ll require 10 rental homes.

But if you strategy to have 50% leverage and the attributes price $100,000, you will have to have to own 20 rentals.

The issue of this move-by-phase course of action was to target your monetary plans down to a specific quantity of rental homes. Your ambitions may well differ, of training course, but I extremely propose you try out the method for your self.

How Numerous Rental Houses Do YOU Require to Retire?

So significantly I’ve shared the straightforward math of real estate retirement, two examples of rental retirement portfolios, and 5 actions to estimate the number of rental properties you need to have to retire.

Will this be a best prediction of your retirement rental money? Of class not. But it does not need to be ideal in order to shift you in direction of your objectives. A sound, approximate aim will do the job.

But most importantly I hope this details will give you self confidence and a sound framework. You can then create upon those to make a retirement earnings from rental properties for yourself.

I desire you a prosperous journey to rental retirement income!♦

How a lot of rental houses do you need to have to retire? Ended up these examples and actions valuable for you? What do you consider about working with rental revenue to fund some or all of your retirement?

Additional Early Retirement Reads:

[ad_2]

Source hyperlink