[ad_1]

Alex Wong

Introduction

I haven’t covered Home Depot (NYSE:HD) since early 2021 when I wrote that investors should hope for weakness. While the ongoing stock market weakness isn’t a lot of fun, I’m extremely excited to see that Home Depot is finally offering new opportunities to investors. Being down more than 30% year to date, Home Depot is now yielding 2.7%. This makes the long-term bull case very juicy given Home Depot’s focus on dividend growth and buybacks. While I do not expect the stock to start a sudden rebound due to macro headwinds, I am not going to pass on the opportunity to double my Home Depot position in the weeks ahead. It’s the only consumer stock I own and by far my favorite consumer cyclical on the market.

Author

In this article, I’m going to guide you through my thoughts using the company’s financials as well as my view on the macro situation, which is where I will start.

So, without further ado, let’s get to it!

The Macro Environment Providing Stock Price Weakness

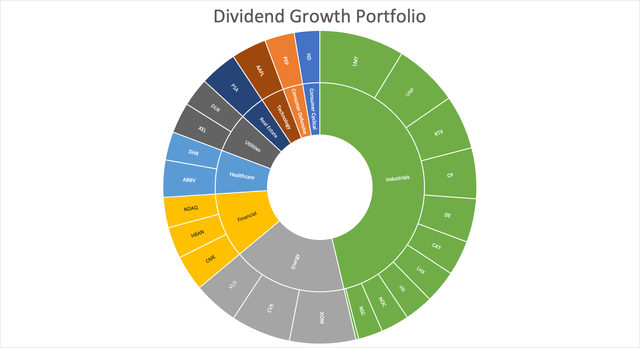

Using end-of-month closing prices, Home Depot is in its worst downtrend since the Great Financial Crisis. Using daily closing prices, we’re roughly 600 basis points away from the -38% drawdown during the 2020 COVID lockdowns.

Author (HD historic drawdowns)

During the period between the end of the Great Financial Crisis and the pandemic, Home Depot has been one of the best-performing stocks in the United States. Drawdowns were very limited – especially in times of manufacturing weakness (2014/2015).

The reason was relatively simple: lower commodity prices caused inflation to drop, which benefitted Home Depot.

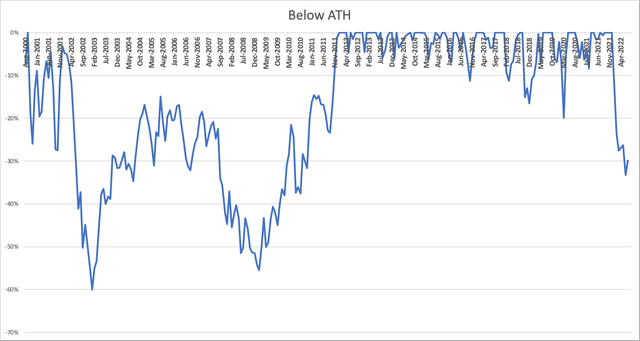

Since 2010, Home Depot has returned 20.9% per year with a standard deviation of just 20.9%. The S&P 500 has returned 12.3% with a standard deviation of 14.3%, which is an excellent result as well. However, it is not enough to beat Home Depot on a volatility-adjusted basis (the Sharpe ratio).

Portfolio Visualizer

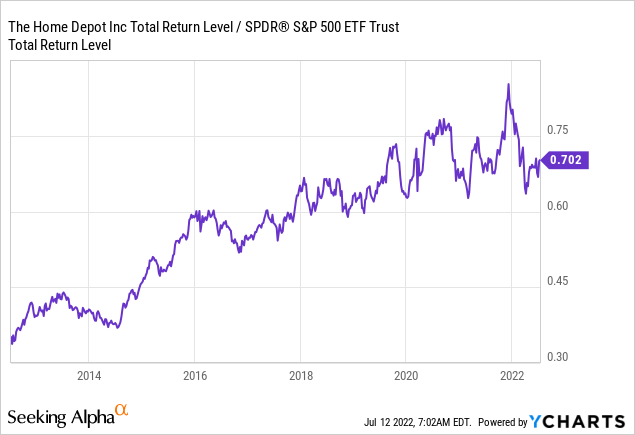

After two drawdowns of more than 30% (the one in 2020 and the current one), Home Depot has seized to outperform the S&P 500. The chart below shows the ratio between Home Depot’s total return and the S&P 500 total return. The ratio is unchanged since early 2020.

The problem is that Home Depot, once an S&P 500 superstar, is now in a very tricky macro environment consisting of a mix of (related) factors like (but not limited to) higher rates, aggressive central banks, and weakening consumer sentiment.

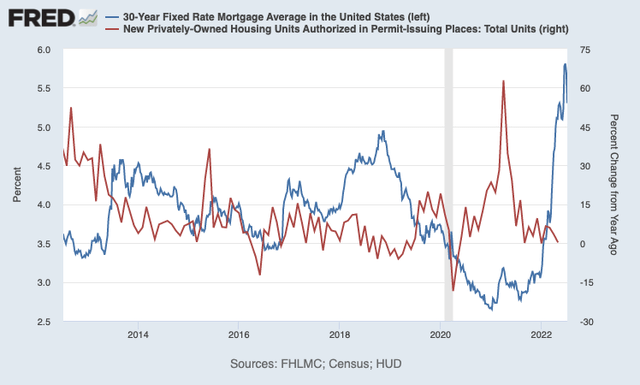

Rates have spiked higher. The average 30-year mortgage rate has made it briefly above 5.5%. These rates exceed prior cycle highs as the Fed is fighting an inflationary force not seen since the 1970s/1980s when supply chain issues not only hurt consumers but also the central bank’s ability to influence prices using higher rates.

St. Louis Federal Reserve

As a result of higher rates, building/housing sentiment is falling. Building permits growth, my favorite indicator of (expected) activity in the industry is now flat and likely to fall as the housing market is showing cracks as the chart below shows and as I explained in this article.

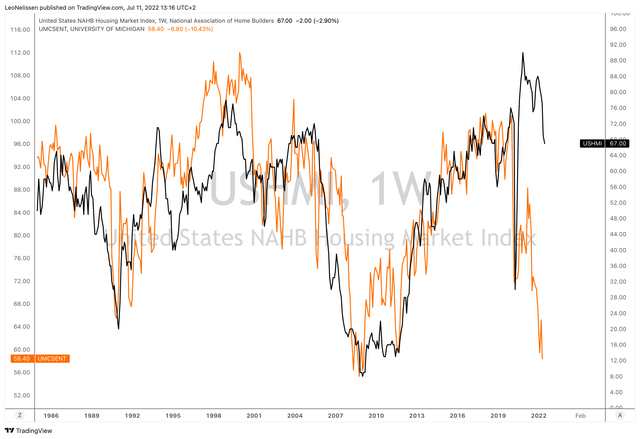

TradingView (Black = Homebuilding Sentiment, Orange = Consumer Sentiment)

As the chart above shows, consumer sentiment is as bad as it was during the Great Financial Crisis. That’s quite something, to put it mildly, and it certainly doesn’t help the US/global consumer.

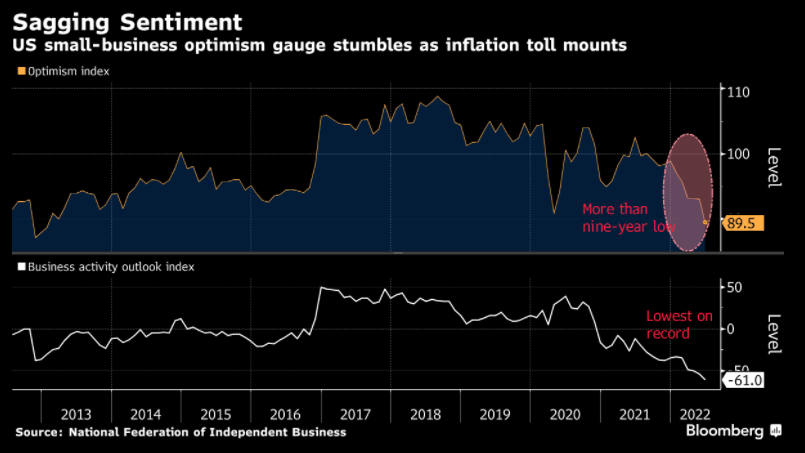

It also doesn’t help small businesses, which just reported a drop in business optimism to a nine-year low. That’s the lowest in the rather short history of this survey.

NFIB (Small Business Sentiment)

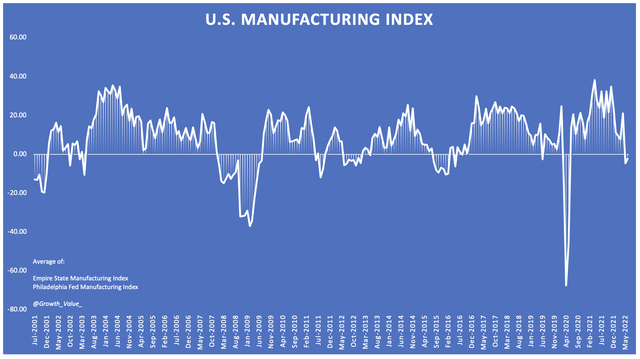

And manufacturing sentiment is suffering as well.

Author (Empire State/Philadelphia Fed)

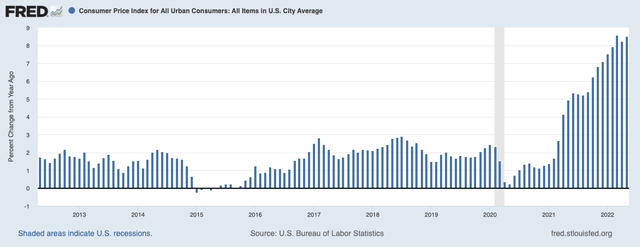

While I believe that consumer prices have peaked at more than 8% annual price growth, I do not believe that inflation is coming down to the 1.5-2.0% range we were used to prior to the pandemic.

St. Louis Federal Reserve

We continue to deal with significant supply issues in energy (as I discussed in this article), agriculture markets continue to see headwinds (as discussed in this article), and ongoing supply chain relocations (away from China) on top of labor shortages are reasons that cause me to believe in long-term above-average inflation.

It’s bad news for consumers and related stocks like Home Depot.

For now, the company continues to remain optimistic. This is what the company commented on May 17:

The demand seen in the first quarter exceeded our expectations. The home improvement consumer remains engaged. Customers continue to tell us that their homes have never been more important and project backlogs are very healthy. We believe that the medium to longer term underpinnings of demand for home improvement have never been stronger. We are thrilled with our Pro performance in the quarter driven by underlying strength in project demand.

[…]

We are navigating a unique environment, but we believe we have the tools, the team and the experience to effectively manage through. While we don’t know how inflation might impact consumer behavior going forward, we are closely monitoring elasticities in customer trends across our respective categories and geographies and remain encouraged by the underlying strength we see in the business.

Yet, I apply a long-term view and think from a business owner’s point of view. So, here’s why I’m looking to double my Home Depot position in the weeks ahead.

Why I’m Doubling My Home Depot Stake

In my opinion, Home Depot is one of the best sources of wealth. Earlier in this article, I showed the company’s outperformance over the S&P 500.

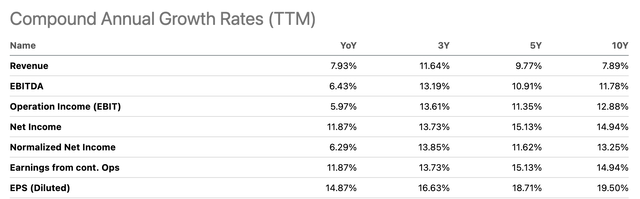

This is no surprise as the company’s historical growth rates are stunning. Over the past 5 years, net income has grown by 15.1% per year thanks to higher margins that leveraged 9.8% annual compounding revenue growth.

Seeking Alpha

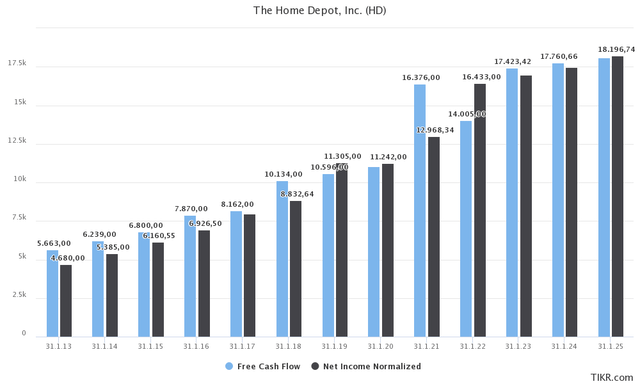

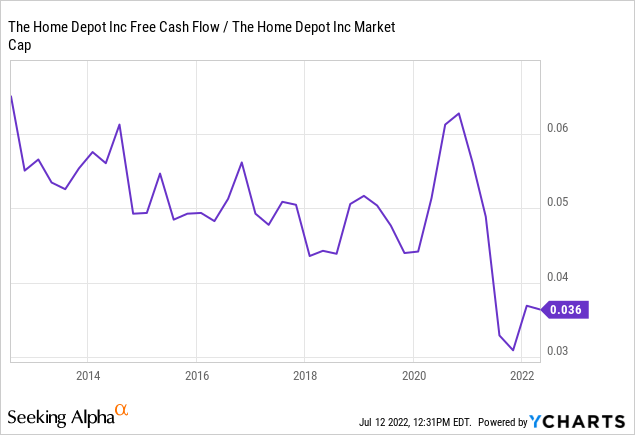

The company has consistently generated more free cash flow than net income, indicating high-quality earnings. In FY2013, the company did $5.7 billion in free cash flow. In FY2023, the company is expected to do $17.4 billion in free cash flow. That’s 24.4% above the prior-year level. In the two years after that, free cash flow growth is expected to slow to 2.0% per year as a result of consumer weakness and the fact that the pandemic has caused a lot of DIY projects to be prioritized.

TIKR.com

With that said, if the company is able to do $17.4 billion in free cash flow, we’re dealing with an implied free cash flow yield of 5.8%.

This means the company can return 5.8% of its market cap to shareholders via dividends and buybacks.

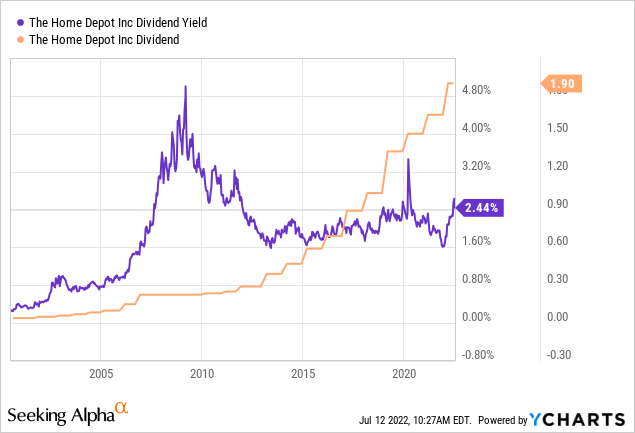

Right now, the dividend yield is 2.7%, one of the highest numbers since the Great Financial Crisis.

Over the past 10 years, annual dividend growth has averaged 17.9%. This number has dropped to 14.1% over the past three years.

The most recent dividend hike was 15.2% on February 22, 2022.

On top of that, Home Depot has a history of aggressive share repurchases. Between FY2013 and FY2022, the company reduced the number of diluted shares outstanding from 1.51 billion to 1.06 billion. That’s a decline of 3.5% per year and a big driver of the company’s outperformance.

The company remains committed to distributing cash to shareholders after servicing capital expenditures and dividends. In the most recent quarter, the company invested $700 million in its business, distributed dividends worth $2 billion, and distributed $2.25 billion via buybacks.

The company distributed money so aggressively that it caused the book value of its equity to drop from $17.8 billion in FY2023 to a negative $3.1 billion in FY2020.

During this period, the net debt ratio rose from 0.9x EBITDA to 1.6x EBITDA. The good news is that 1.6x EBITDA is still very low. At the end of this year, this ratio is expected to be 1.5x EBITDA.

As a result, Home Depot has an “A” credit rating with a stable outlook.

Valuation

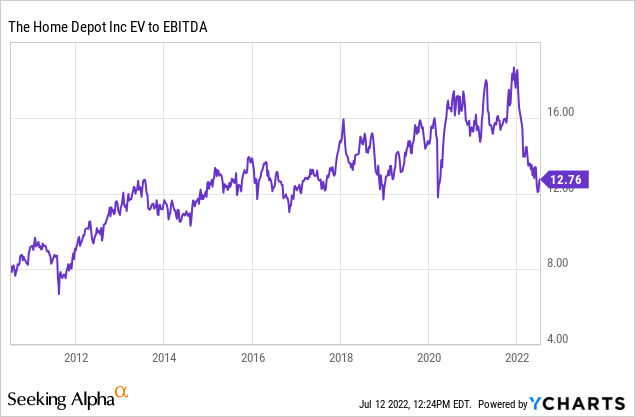

Using the company’s $300 billion market cap and $41 billion in net debt, we get an enterprise value of $341 billion. That’s 12.7x this year’s EBITDA.

It’s a more than fair valuation, which is now in line with pre-pandemic levels. And while there’s a chance that EBITDA will underperform due to above-average inflation and lasting consumer weakness, I think it’s a good price to pay for a long-term investment.

Moreover, the implied free cash flow yield of 5.8% is one of the highest in years.

While I cannot make the case that HD is at its lows, I like the risk/reward looking forward. A company that rarely sells off this much as distributes whatever it can to its shareholders thanks to a stellar business model is a good buy on a steep decline like this. For now, I’m up roughly 18% on my current position and I expect to buy HD over the next 4-8 weeks depending on my personal cash flows.

Takeaway

We’re in a very tricky macro environment. Inflation is high, supply chains are broken, and the Federal Reserve is determined to combat inflation by any means necessary while geopolitical tensions add more fuel to the fire.

Home Depot is one of the biggest victims. While the company continues to deliver great results with a healthy dose of optimism, investors disagree. The company has been in freefall since the end of 2021 as a toxic macro mix is hitting investors’ willingness to take risks.

It also doesn’t help that Home Depot was one of the biggest “post-pandemic” winners, which made profit-taking more attractive.

While it’s hard/impossible to call for a bottom, I’m extremely eager to double the HD position I initiated in 2020.

The company has a 2.7% dividend yield, aggressive dividend growth, strong free cash flow (even if growth remains low), and a valuation that has incorporated a steep decline in future EBITDA growth.

It’s a very attractive value proposition from a dividend-growth point of view.

However, if you are new to HD and want to initiate a position, I recommend doing it in steps. For example, buying 25% now and adding over time allows investors to average down if the market keeps falling. If the stock suddenly takes off, investors have a foot in the door.

(Dis)agree? Let me know in the comments!

[ad_2]

Source link