Reduced premiums and rosy assumptions about how substantially lease properties could possibly acquire helped fuel the file $5 trillion personal debt boom in U.S. industrial actual estate more than the earlier 10 years.

But as the COVID-19 pandemic threatens to rewrite numerous of the policies about where folks do the job, store and commit their leisure time, the major concern continues to be: What may it all suggest for industrial serious estate?

“Commercial true estate (CRE), in our watch, tops the record of sectors that are most at threat of declining asset excellent amid the coronavirus pandemic — which would lead to losses for U.S. banks,” wrote a group of analysts led by S&P International Rating’s Stuart Plesser in a new report Monday.

Whilst Plesser’s crew expects most financial institutions with no large exposure to easily endure their projected 3% “base case” reduction on industrial real estate, they also warned that the reduction premiums could close up hitting 10% or greater, which would suggest “a considerably much more substantial dent to the banking sector that would most likely lead to downgrades for numerous banks.”

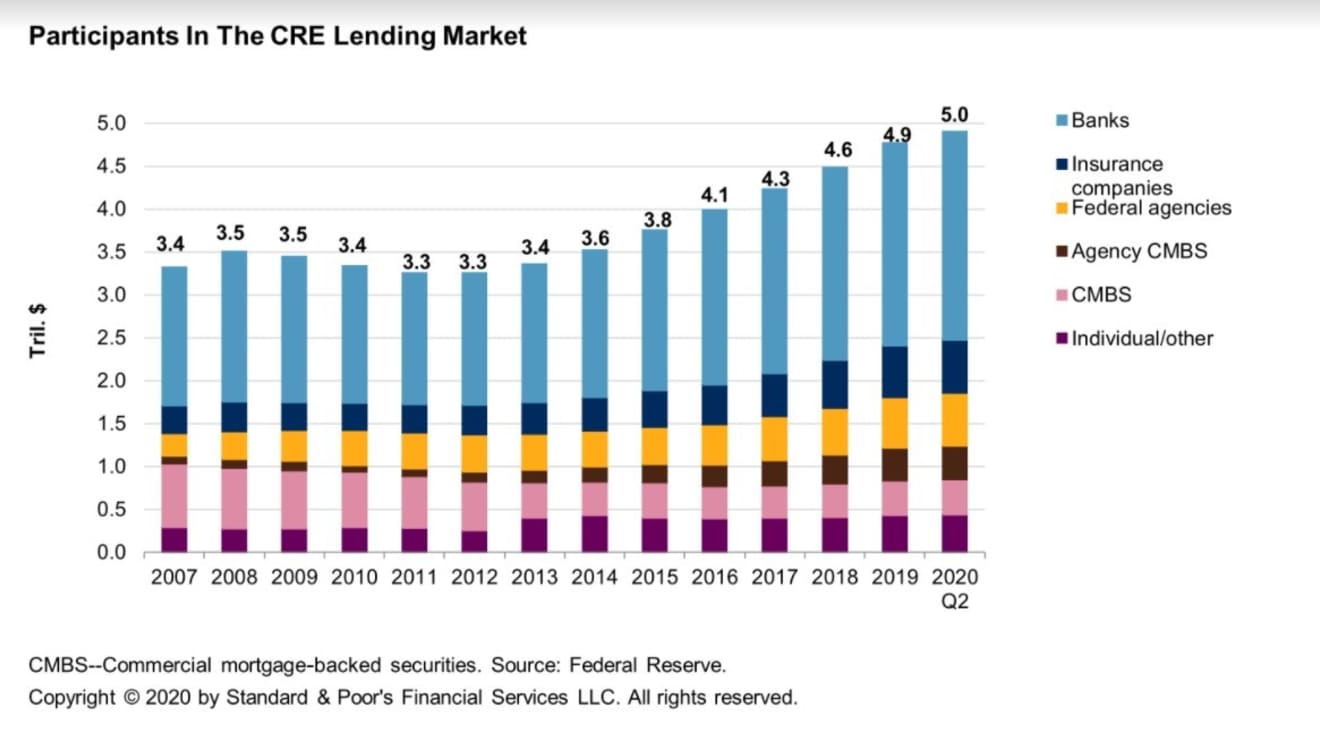

Here’s their chart exhibiting banking companies very own about 50 % of U.S. business serious-estate personal debt:

Who owns $5 trillion CRE personal debt

S&P World wide, Fed info

For context, the Federal Reserve claimed it expects creditors to expertise a 6.3% ordinary decline beneath a “severely adverse scenario” on all loans held by banking institutions, together with credit history playing cards, car financial loans and company credit, as part of its 2020 strain assessments.

That would equate to a blended $430 billion decline above a nine-quarter outlook, but the Fed also claimed losses could stop up hitting 10.2% if the financial restoration ends up staying rockier.

“If decline fees ended up to attain these levels, no question the smaller sized banks with additional exposure would truly feel significant suffering,” Plesser’s workforce at S&P Worldwide wrote.

What’s much more, S&P thinks the pandemic could reshape parts of commercial real estate in strategies that the Fed’s stress exams just can’t foresee, together with if corporations undertake additional “liberal work-from-household policies” that could slash into need for place of work space.

See: Place of work sector is a ‘big question’ states this industrial genuine estate veteran

And though it’s recognised that retail and lodging have been challenging strike, a comprehensive photo of the financial toll of the worst public-overall health crisis in a century continues to be considerably from recognized, notably considering that COVID-19 conditions in November have surged to alarming new documents.

Verify out: Not once more! Economy faces an additional rigid check from record coronavirus surge

In the struggling mall sector, Taubman Facilities

TCO,

above the weekend agreed to a reduce rate to merge with Simon Assets Group

SPG,

evading what could have been a heated lawful fight through the holiday seasons.

Relevant: Simon House provides up on four battling malls. Why a lot more could comply with

But analysts at BofA Worldwide also pointed out that distressed profits only accounted for about 1% to 2% of the overall commercial actual-estate transactions finished in the 2nd and 3rd quarters.

“Until distressed asset sales boost in a sizeable way, we anticipate that asset pricing metrics will keep on being rather idiosyncratic,” BofA’s staff wrote in a weekly report.

Until finally then, it may perhaps be intelligent to maintain an eye on how true-estate expenditure Trust (REITs) shares trade, according to S&P’s Plesser.

“Notably, the stock rates of publicly traded REITs are down about 25% for most of the CRE subsectors, signaling that traders believe that the CRE market is probable to have some troubles down the street.”

When wanting at big trade-traded money in commercial real estate, the Vanguard True Estate ETF

VNQ,

ended Monday down 7% for the 12 months to day, or around the exact same as the iShares U.S. Genuine Estate ETF

IYR,

according to FactSet Details.

The S&P 500 index

SPX,

and Dow Jones Industrial Regular

DJIA,

shut Monday at new data amid a lot more promising developments on the COVID-19 vaccine entrance.