[ad_1]

Respondents, who provided the firm’s clientele and other senior commercial genuine estate executives, were requested to amount their self-confidence about the authentic estate market place more than the upcoming 12 months on a scale of 1 to 10, with a score of 6 to 10 viewed as optimistic. In 2021, 74 % of respondents experienced responses in the 6-10 portion of the self-confidence scale. This yr, 73 per cent of respondents have been optimistic, but a increased proportion of respondents (33 p.c vs. 16 p.c) ranked their sentiments in the 8-10 portion of the scale. In contrast, 21 p.c of respondents have been optimistic in 2020.

“The bulls became far more bullish in this study compared to prior surveys,” claimed John Sullivan, chair of DLA Piper’s U.S. Serious Estate Exercise and co-chair of its World wide Real Estate follow, told CPE.

The firm’s “Global Authentic Estate Once-a-year Condition of the Market Survey” was produced solely to CPE right now, and will be formally unveiled tomorrow at the firm’s 17th World Actual Estate Summit in Chicago.

Long lasting Momentum

Genuine estate transaction volume rebounded resoundingly in 2021. Transactions not only surpassed 2020, when the marketplace almost stood however, but also exceeded pre-pandemic stages. This study would seem to point out the momentum is continuing.

It should really be famous, even so, that market place disorders have shifted somewhat considering that DLA Piper surveyed respondents in mid-February and mid-March. If the same respondents were being surveyed currently, the thoughts may possibly be a little bit diverse.

“The raises in interest costs were being frequently expected by the sector, but what was not expected was the severity of the war in Ukraine and the pace at which inflation has absent up,” Sullivan remarked.

But desire premiums are however traditionally reduced and, though inflation may perhaps curtail enhancement thanks to rising costs, there is a flip facet to inflation for professional real estate simply because serious estate entrepreneurs can elevate rents to hold up with inflation, Sullivan pointed out.

Hunting Up

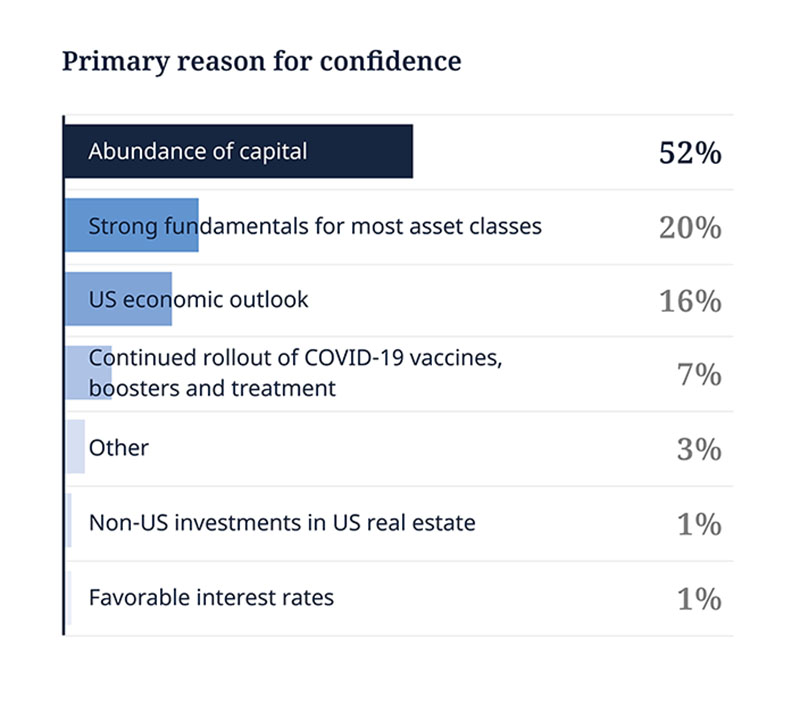

“It would be superior to see energy of fundamentals as the amount-one particular factor persons level to, as opposed to the amount of money of funds, but the total of cash is critically vital,” stated Sullivan. “They are clearly connected.”

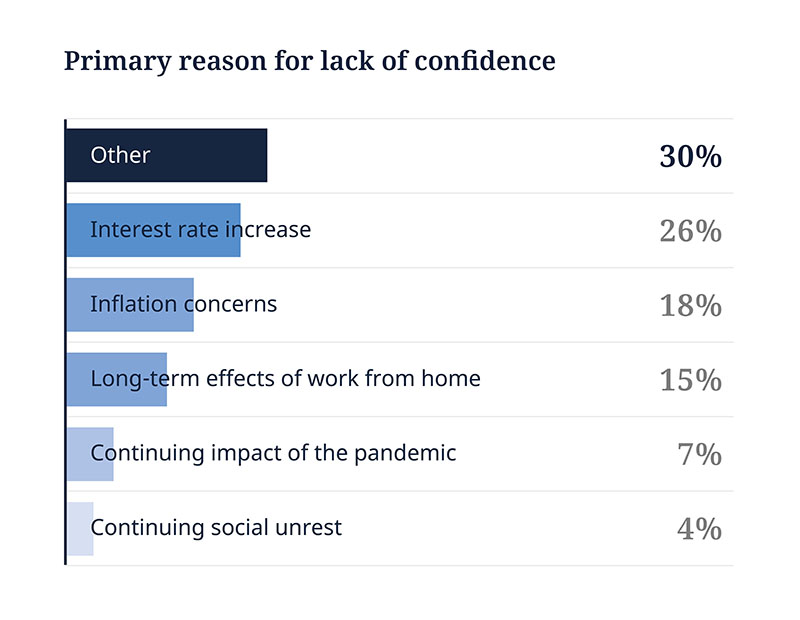

The principal motives for lack of assurance ended up “other” (respondents cited greater international tensions in their no cost-variety comments), followed by interest rates and inflation, prolonged-phrase outcomes of operate-from-home, continuing impression of the pandemic, and continuing social unrest.

Hybrid Get the job done and Southern Migration

Not remarkably, respondents consider that inflation (84 %) and interest charge improvements (76 %) will have the finest impacts on professional actual estate. Seventy-two % consider e-commerce will have an impression.

The subsequent most influential craze, according to the survey outcomes, is “the redesign/reimagining of workplace and other business spaces.” Sixty-one particular per cent claimed this would be impactful during the up coming 12 months.

Even more, in response to an additional question on that matter, 47 percent of respondents predict that 50 percent of personnel will be back in their places of work regularly in a yr, and 43 % feel that 75 p.c of workers will be back again in the place of work. Only 2 % of respondents believe that that workplaces will be 100 percent occupied.

Also, about 20 % forecast that business vacancies will never get back again to their pre-pandemic ranges, and 28 p.c reported suburban business office was most likely or really probable to return to pre-pandemic amounts in the following 12 months, as opposed to only 15 percent anticipating urban business office to return to pre-pandemic ranges within a yr.

“Not that it is so a lot of a surprise, but the information that seems to be coming from that is there are going to be extensive-time period impacts resulting from the complete operate from home thing,” Sullivan stated.

It is a tiny early to tell definitively, nevertheless, no matter whether the variations in place of work actions will be long lasting, Sullivan remarked, and it can be perilous to make generalizations about workplace since new business office structures these days have a very clear benefit more than more mature structures.

Forty-4 per cent of respondents reported “migration of workforce from densely populated metropolis centers” would have an effects on the subsequent 12 months. That is dependable with what Sullivan explained as the “fairly dramatic” shift of trader interest in what ended up generally regarded secondary towns, notably these in Solar Belt towns.

“It utilised to usually be the gateway towns,” Sullivan claimed. “It was New York, San Francisco, L.A. and Boston. All the traditional cities employed to be at the leading of the checklist and now you get Austin, Raleigh-Durham, Nashville, Phoenix and Miami as the top towns.”

A single shock for Sullivan was that ESG did not emerge as a additional urgent priority in the survey final results. Forty-4 % of respondents mentioned ESG would have an impact, but only a 3rd claimed ESG would move from a secondary concentrate to a most important aim.

“For virtually all of our institutional consumers, it is a quite vital point,” explained Sullivan. “Maybe a very little bit of that is how we phrased that in the survey. But I would have considered that arrived out a little bigger.”

Daily life Science Emerges

Industrial (66 percent) and multifamily (57 per cent) remain the residence sorts that traders feel supply the most effective possibility-modified returns more than the following 12 months. Other leaders on the most effective returns list have been daily life science (56 p.c), facts centers (45 p.c), and industrial/production, excluding logistics, ware housing and cold storage (38 percent).

While existence sciences’ placement on the checklist is not amazing, Sullivan pointed out, the expansion of the assets sector around the last two years has been.

Funds-Fueled Confidence

Funds-Fueled Confidence

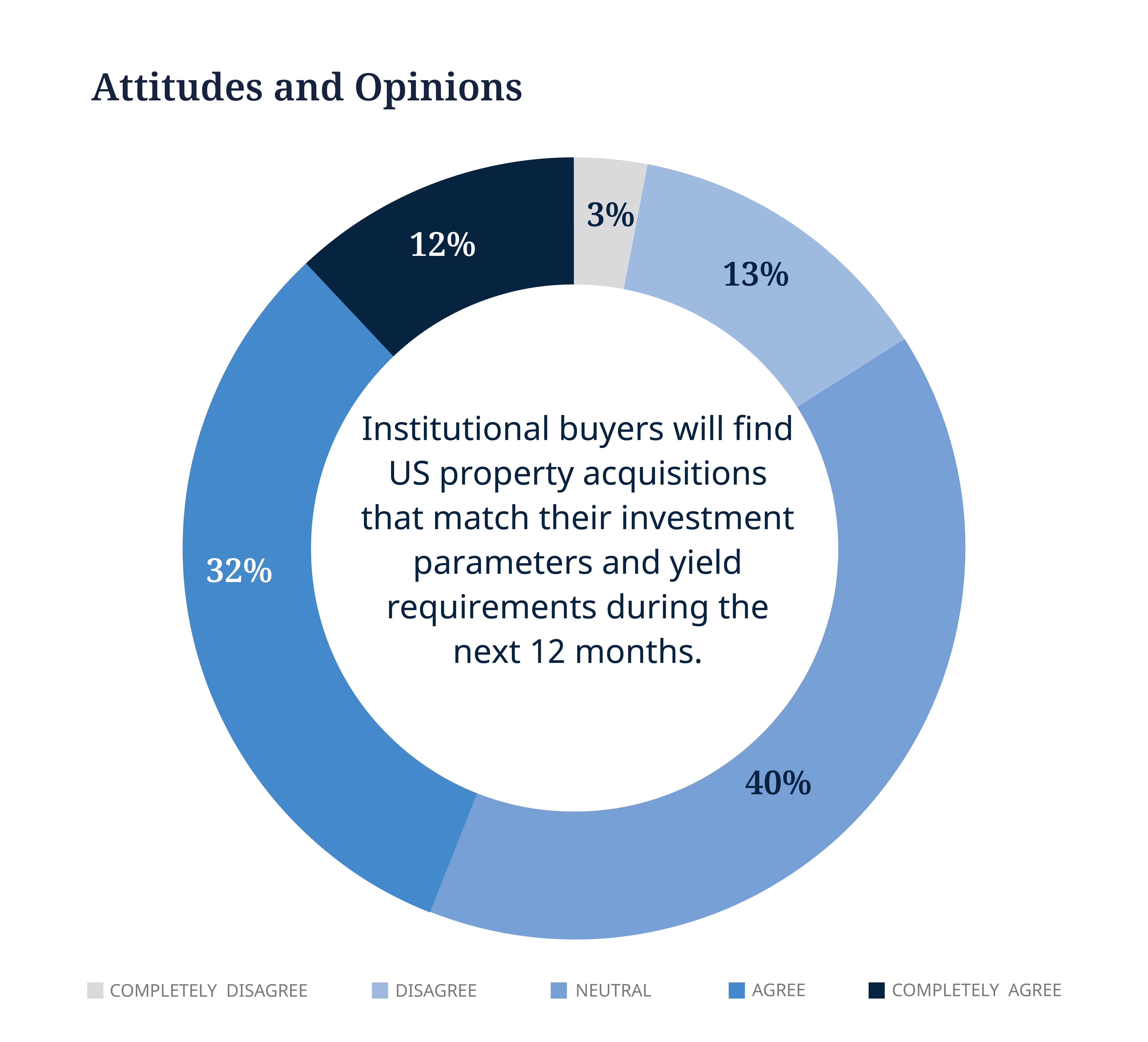

The connection in between the volume of cash in authentic estate and the confidence in the industry is no tiny matter. Authentic estate has turn into a really vital asset class to institutions, as evidenced by the improve in transactions—both the amount and dimension. Meanwhile, the top quality of capital participating has strengthened the asset course.

“Real estate, in general, has not gotten overbuilt,” claimed Sullivan. “There are exceptions but, in typical, it has not overleveraged. That has been a huge alter in around the last 20 years. It applied to be a lot more smaller sized players and bigger leverage and, of training course, far more volatility.”

Non-public fairness, according to respondents, will go on to be the most lively variety of trader.

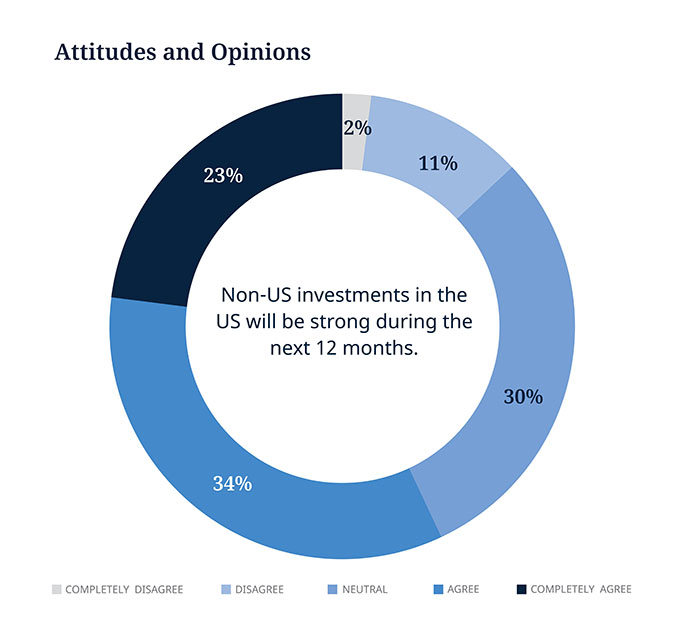

Respondents also feel that non-U.S. investments in U.S. commercial genuine estate will boost, expanding by 14 percentage in excess of 2021 projections.

“When you have international instability, that usually prospects to an boost in locations viewed as safe havens,” claimed Sullivan. “The U.S., even with our worries, is continue to viewed as the No. 1 safe and sound haven.”

[ad_2]

Resource link

Funds-Fueled Confidence

Funds-Fueled Confidence